The transformation journey started in 2012 in Saudi Arabia’s Eastern Province when Retal Urban Development joined the Stellar Al Fozan Group of Companies and began to develop residential, commercial and mixed-use properties.

Our developments create a majestic pursuit by Infusing character into a place. They provide an extraordinary value, occupy Strategic locales and generate high returns on investments.

Investment

Location

Lifestyle

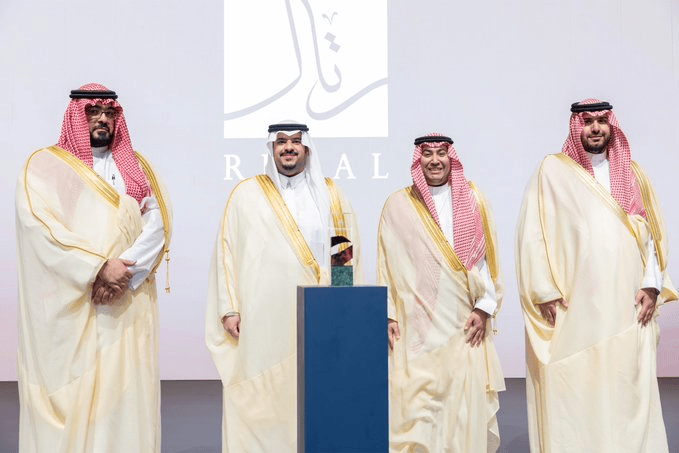

Leadership

Quality

Price

Privacy Policy • Terms of use

© 2023 Retal Development. All rights reserved.